Welcome to a financial frontier where budgeting transcends the mundane and becomes a powerful tool for shaping a prosperous future. In our journey together, we will embark on a quest to unravel the intricacies of budgeting beyond basics and elevating your financial game.

It is time to elevate your financial game and sculpt a future that resonates with abundance and security. Join us as we redefine the art of budgeting and set the stage for financial success like never before.

Story Stages

Top 12 Tips for Elevating Your Financial Game Through Budgeting

Any conversations about money would be incomplete if numbers were not involved. Furthermore, specific principles in Mathematics form the basis of financial discipline. Go through these details as they decipher each one, explaining how.

1. Income

When budgeting and managing finances, income is one of the crucial entities in the equation. It is a summation of all the money coming into your pockets and accounts. It includes your salary, dividends, rental income, bonuses, and cash from other sources.

2. Expenses

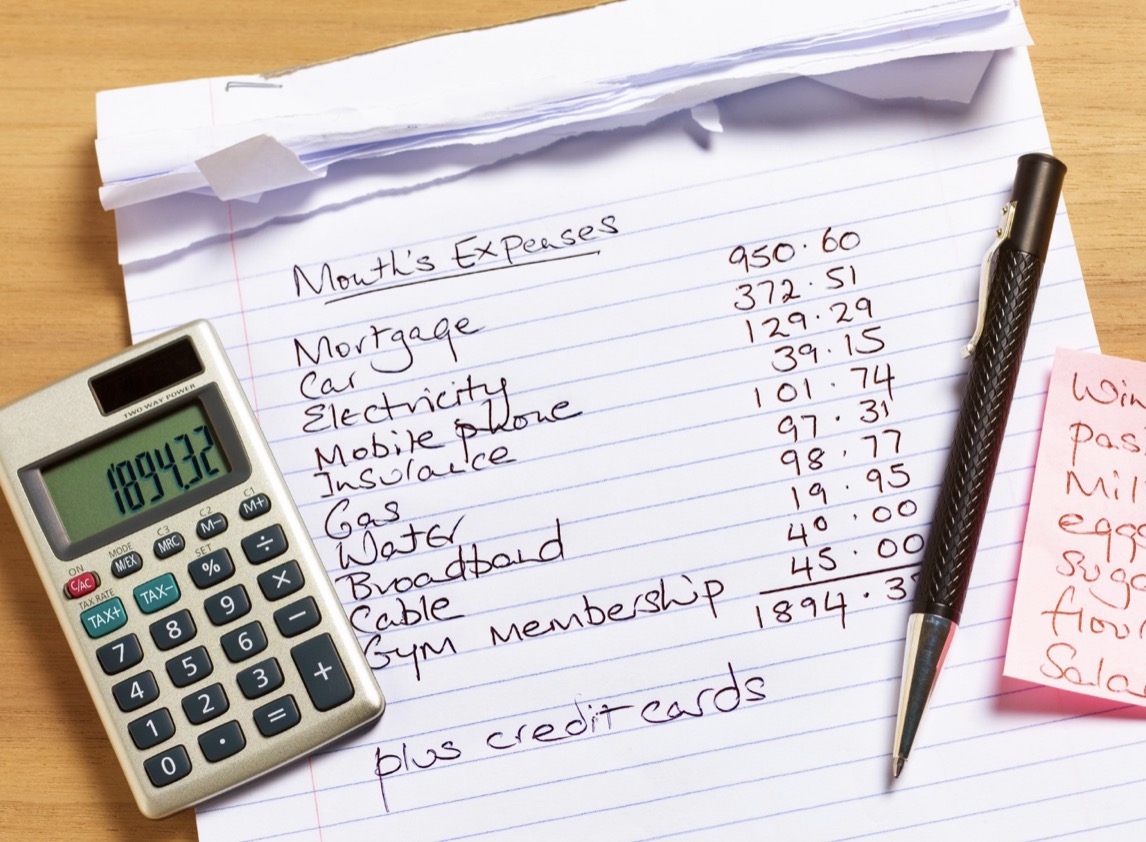

Unlike income, which brings out a connotation of addition, the term expenses is the inverse. It refers to the summation of all the money leaving your account.

It includes bills such as a mortgage, rent, utilities, insurance contribution, money spent on groceries, paying off salaries and debts, subscription services, and deposits for investments. Budgeting is a factor of the two key components: income and expenses.

Using basic Math principles, you can calculate the percentage of the expenditure compared to your income. The figure obtained will determine whether you are on the right track financially and how much control you have over your finances.

3. Financial Goal Setting

Unlike other goals, setting financial goals requires you to be in touch with the numbers. The most daunting part about this process is how honest you have to be with yourself. You must account for every cent, including the money spent to pay a research paper writer.

Using simple arithmetic functions, you can calculate your expenses, how much you can save, and how much money you will dedicate to servicing a debt or paying for an asset. These details are the factors that play a crucial role in financial goal setting.

4. Budgeting

Coming up with a budget entails subtracting the expenses from the income. It also involves getting into details on how much money you spend on your needs and wants.

This information is vital in determining the changes you ought to make to attain your financial goals. It also opens you up to your financial fortitude and the lucrative investment opportunities you could consider.

5. Allocating Funds

The numbers established during the budgeting process allow the allocation of funds to the different expenses. This step involves establishing what you spend your money on and factoring in the possibility of the prices in the market rising.

For instance, you can divide your income into fixed and variable expenses. Your fixed expenses are those that do not change and require you to service them regularly. You only incur varied expenses occasionally.

You should also indicate how much you will be allocated to investments and savings. Financial experts advise that you should deposit funds into these accounts first before tackling your other expenditures.

6. Spending

Outlining your expenses is one thing; tracking the costs is another. For instance, tracking your expenditures entails getting into bits about deducting your daily or weekly expenses from the funds allocated in the budget. It also involves being specific about payment details, including the cost of essay writing services. Providing this information is fundamental in ensuring you stay on track.

7. Surpluses

A well-detailed budget should include the expenses, income, shortfalls, and surpluses. Providing these details helps determine the budget areas that require changing and tweaking. It also helps ensure a fair distribution of finances depending on your spending.

8. Debt

Debt management is another fundamental part of budgeting that requires a keen interest in numbers. Simple arithmetic should determine how much you have paid towards your debt. It should also enable you to calculate how much more needs to be paid.

Math concepts also come in handy when calculating the percentage interest accrued from a debt. In cases where the interest rate is ambiguous, you can adjust the payment plan.

9. Investments

Another fundamental use of Math in finances is investments and savings. Using simple arithmetic, you can calculate how much you will have as savings after a given period.

Alternatively, you can establish how much money you ought to invest monthly to attain a specific level of financial freedom. When calculating the value of your investment, use math concepts to calculate the value of your compound interest.

10. Emergency Funds

If you are looking at diversifying your saving opportunities, having an emergency fund is a branch you should explore. Calculating the size of your emergency fund is fundamental. It should comprise at least six months’ worth of expenses.

You can determine how much you will deposit to this account monthly using a simple Math concept and the current inflation rate. Explore other special funds like a sinking fund dedicated to saving for short-term goals and purchases.

Separating your savings also fosters discipline when dealing with money. It also cultivates honesty within yourself and structure in managing your money.

11. Review

Regularly reviewing your budget involves employing Math principles to assess your progress toward meeting your financial goals.

12. Adjust

If you feel unsatisfied with the results and progress of your journey, go back to the basics and adjust your budget or financial goals.

As you navigate the twists and turns of your economic narrative, may the knowledge gained here serve as a compass, guiding you toward financial stability and true mastery over your financial destiny. The journey does not end here; it transforms into a dynamic expedition where you continue to refine, innovate, and thrive.

Armed with these elevated budgeting strategies, you are not just a passive spectator in the theater of your financial life; you are the director, the producer, and the lead actor. So, go forth confidently, armed with the wisdom to elevate your financial game.