The foreign exchange (Forex) market is a towering giant in the financial world. Its sheer volume, liquidity, and span encapsulate a global phenomenon that has remained unsurpassed by any other market. Drawing from the comprehensive BIS Triennial Central Bank Survey of 2022, this detailed article sheds light on the size and intrinsic dynamics of the Forex market.

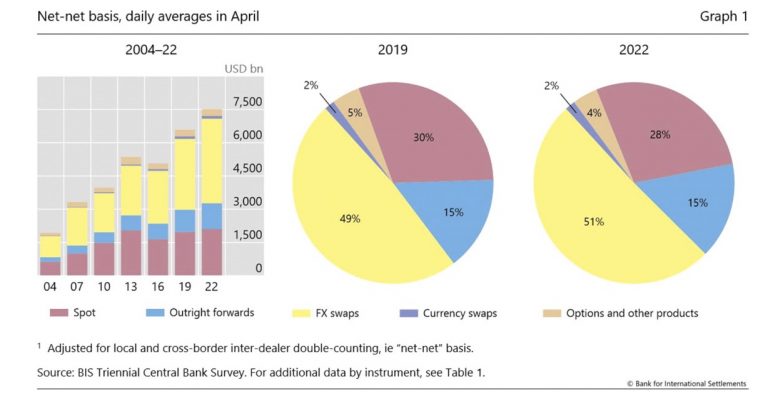

The BIS Triennial Central Bank Survey, an unparalleled source on the size and structure of over-the-counter (OTC) markets, captured that trading in OTC Forex markets skyrocketed to an astounding $7.5 trillion per day in April 2022. This was a notable jump from $6.6 trillion just three years prior. Such huge trading volumes demonstrate the Forex market’s dominant stance and meteoric growth trajectory.

Story Stages

Unpacking The Numbers: What We Know About FX Trading

- Dominance of Specific Instruments: The lion’s share of this turnover can be attributed to FX (Forex) swaps, which constituted 51% of global turnover. Meanwhile, spot trades took up 28%—a slight dip from 30% in 2019.

- Inter-dealer Trading: A fascinating aspect is the trading dynamics among the reporting dealers, which reached $3.5 trillion or 46% of global turnover. This reflects the heightened dealer-to-dealer activity.

- Currency Powerhouses: The US dollar, an undeniable stalwart, was involved in 88% of all trades. Trailing behind, the euro, Japanese yen, and pound sterling held their positions firmly. The Chinese renminbi, however, made impressive strides, moving from eighth to fifth place in most traded currencies in just three years.

- Geographic Epicenters: The pulse of Forex trading strongly beats in five key jurisdictions: the UK, USA, Singapore, Hong Kong SAR, and Japan, together accounting for 78% of global FX trading. Of these, the UK, with 38% of global turnover, remains the world’s undisputed Forex capital.

Several factors played key roles in these forex trading numbers. The fluctuating expectations about interest rates in major economies, geopolitical ripples like the Russian invasion of Ukraine, and even the shadows of the Covid-19 pandemic shaped trading behaviours and patterns.

Furthermore, inter-dealer trading witnessed a surge, possibly due to elevated currency market volatility. Such times typically see a proliferation of inventory imbalances from customer trades, necessitating frequent offloads in the inter-dealer market.

*Traders are strongly advised to read and learn about global forex trading and the factors impacting the forex market.

Forex Trading Sessions Time Zones

Spring/Summer in the Northern Hemisphere

|

Forex Trading Session |

Local Time |

GMT |

|

Sydney |

07:00 – 16:00 |

21:00 – 06:00 |

|

Tokyo |

09:00 – 18:00 |

00:00 – 09:00 |

|

London |

08:00 – 16:00 |

07:00 – 15:00 |

|

New York |

08:00 – 17:00 |

12:00 – 21:00 |

Autumn/Winter in the Northern Hemisphere

|

Forex Trading Session |

Local Time |

GMT |

|

Sydney |

07:00 – 16:00 |

20:00 – 05:00 |

|

Tokyo |

09:00 – 18:00 |

00:00 – 09:00 |

|

London |

08:00 – 16:00 |

08:00 – 16:00 |

|

New York |

08:00 – 17:00 |

13:00 – 22:00 |

Always consider practicing with a Risk-Free Demo Account before diving into real forex trading.

Importance of Forex Trading Time Zones

- Volatility and Liquidity: The overlapping hours between two trading sessions are the most volatile because there’s a higher trading volume when two markets are open simultaneously. This can lead to sharper price movements.

- Best Trading Opportunities: Major news releases usually come out at the beginning of a trading session. High liquidity combined with significant news can lead to large currency price swings, which can be an opportunity for traders.

- Determining Trend Directions: The beginning of each session is when major institutions, like banks and hedge funds, begin their trading day, and their trading actions can dictate the market’s direction.

- Strategic Planning: Knowing session times can help plan trades around major economic news releases or avoid them altogether if a trader doesn’t want to get caught in potentially volatile situations.

For Canadian traders, it’s essential to understand these time zones to trade effectively on the global stage. Moreover, the regulatory landscape in Canada ensures a safe and transparent trading environment, allowing Canadian traders to confidently navigate the forex market.

Key Drivers of Forex Markets: Understanding Economic and Political Factors

Source: MetaTrader Forex Trading

The forex market, a global platform with daily trades amounting to trillions of dollars, is heavily influenced by a multitude of macroeconomic factors. These factors range from inflation, which profoundly impacts forex, to other capital markets.

These include stocks, bonds, and commodities, which significantly affect exchange rates. International trade, especially trade deficits and surpluses, is critical in shaping the forex landscape.

By the same token, political developments, from election outcomes to changes in economic policies, can have immediate ramifications on the perceived value of a nation’s currency.

Economic reports, including GDP (Gross Domestic Product), inflation rates, employment, and other statistical data, are necessary tools for forex traders, offering insights into a country’s economic health and, by extension, the strength of its currency.

It’s critically important to understand these economic indicators and their implications in the forex trading arena.